Yes Bank

On Feb-9, it might go to 14.60 INR. It can test out even 15 INR as well. Volume is also good. Very prospective stock for tomorrow. It has breached 200 EMA (Exponential Moving Average). It has attempted to come above 15 INR a couple of times before. - - - - -Blue Star

It has broken 200 EMA. 25% appreciation between 31-Jan-2022 and 7-Feb-2022. It makes even more sense to buy this stock today in February as the summers are coming (not joking). It is a 'Cyclic Seasonal Stock'. - - - - -Century Plyboards

Good stock but showing resistance at 630 INR.

Pages

- Index of Lessons in Technology

- Index of Book Summaries

- Index of Book Lists And Downloads

- Index For Job Interviews Preparation

- Index of "Algorithms: Design and Analysis"

- Python Course (Index)

- Data Analytics Course (Index)

- Index of Machine Learning

- Postings Index

- Index of BITS WILP Exam Papers and Content

- Lessons in Investing

- Index of Math Lessons

- Index of Management Lessons

- Book Requests

- Index of English Lessons

- Index of Medicines

- Index of Quizzes (Educational)

Tuesday, February 8, 2022

Stock Tips (2022-Feb-8)

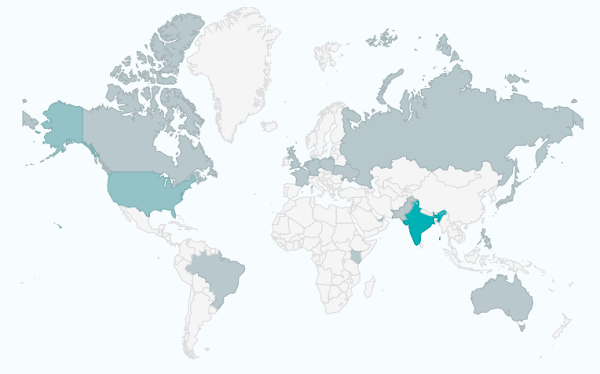

Audience Around The World (Feb 2022)

Doughnut Chart Countries

World Heat Map

List of Top 20 Countries with View Counts

Top Locations

- India

- United States

- Germany

- Russia

- United Arab Emirates

- Kenya

- United Kingdom

- Singapore

- Canada

- Netherlands

- France

- Brazil

- Ukraine

- Philippines

- Hong Kong

- Australia

- Pakistan

- Japan

- Poland

Past 3 Months - Daily Views

Tags: Investment,Management,

Monday, February 7, 2022

Stock Tips 2022-Feb-7

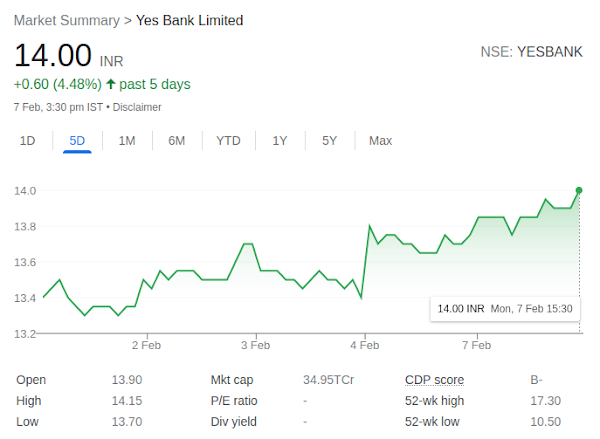

Yes Bank

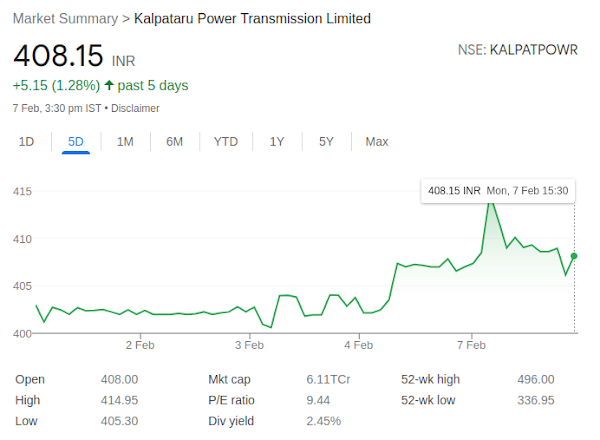

At 14.25, it has 200 EMA (Expotential Moving Average). 14.95 is it's resistance. If it breaks 15, then it might go to 18.Kalpataru Power

It has come above 200 EMA.Aarti Drugs Ltd.

It has come above 200 EMA in 'Hourly Candle'. For 'Daily Candle', it will try to come above 200 EMA.Dhani Services Ltd.

It is about to break previous resistance.Castrol India Limited

Div yield: 4.42% Very good dividend yield.In Images:

Aarti drugs ltd - 5 Years

Castrol - 1 Days

Dhani - 5 Days

Kalpataru power - 5 Days

Yes bank - 5 Days

Nifty50 - 5 Years

Tags: Investment,BODMAS - Step by Step Working (Grade 6A)

BODMAS: Brackets of Division, Multiplication, Addition, Subtraction

To solve the problem, we are following the way Google processes our above question, i.e., left to right.

Tags: Mathematical Foundations for Data Science,

Set the difficulty level:

To solve the problem, we are following the way Google processes our above question, i.e., left to right.

Also, to simplify calculations, we are rounding off answer from division part to the lower integer, i.e. floor function.

Sunday, February 6, 2022

Stock Tips 2022-Feb-7

Tags: Technology,InvestmentCDSL

% Consolidating since Oct-Nov 2020. % It can give breakout on positive side. % Stamp Duty, Transactional Revenue goes to CDSL. % Volume of trading goes up every day, so CDSL is a good stock to buy.HCL Technologies

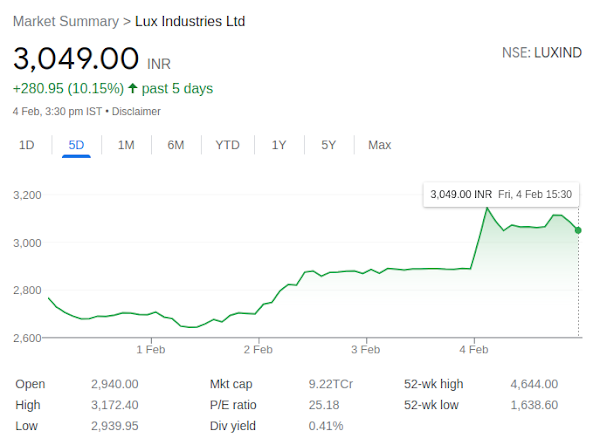

% It has closed above 200 EMA (Exponential Moving Average).Lux Industries

% It is attempting to come above 200 EMA, which it recently broke.IEX

% Hold a little. % Monopoly business. % Good consolidation has happened in past couple of months. % Ready to rock and roll in coming months. All four of these stocks are good from long term perspective. When you think long-term, you can put 10%-15% stop-loss for a return of 25%-30%.1. BSE - 1 Day

2. BSE - Past 6 Months

3. BSE - Past Year

4. BSE - Past 5 Years

5. CDSL - 1 Day

6. CDSL - Past 5 Days

7. CDSL - Past 6 Months

8. CDSL - Past Year

9. CDSL - Past 5 Years

10. HCL - Past 5 Years

11. IEX - Past 5 Years

12. Lux Ind. - 1 Day

NSE: LUXIND13. Lux Ind. - Past 5 Days

Saturday, February 5, 2022

Create Table Statement and Constraints Assignment

Table Creation and Data insertion: Create following Tables with required constraints (as mentioned) using SQL DDL.

Table: Student

| sid

(int) Primary Key |

sname

Varying Char (10) |

sbranch

Char(5) |

sage

(int) (not greater than 25) |

| 1001 | Kamal | IT | 18 |

| 1004 | Yogesh | IT | 17 |

| 1011 | Mani |

CSE

|

20

|

|

1022

|

Farooq

|

EEE

|

21 |

|

1027

|

Girija

|

CSE |

24

|

|

1030

|

Mousmi

|

CSE

|

22

|

|

1036

|

Rajanish

|

EEE

|

21

|

|

1052

|

Praneet

|

EEE

|

21

|

|

1059

|

Joseph

|

CSE | 17 |

| 1063 | Lahiri | IT | 21 |

Table: Course

|

cid

(int) PK |

Cname

(chars 4 and unique) |

units

(int) |

| 10 | OS | 3 |

| 20 | DBMS | 4 |

| 30 | CNW | 5 |

| 40 | PHY | 3 |

Table: StudentCourse

|

stid

PK1 and FK to sid of student |

cno

PK2 and FK to cid of course |

| 1001 | 20 |

| 1001 | 30 |

| 1004 | 10 |

|

1004

|

20

|

|

1004

|

30

|

|

1004

|

40

|

|

1027

|

20

|

|

1027

|

30 |

| 1036 | 10 |

| 1036 | 30 |

| 1036 | 20 |

| 1059 | 10 |

| 1063 | 20 |

Solution

Tags: Database,Technology,DDL: Data Definition Language

- create - alter - dropDML: Data Manipulation Language

- select - insert - update - deleteMicrosoft SQL Server

How to add a "Check Constraint" on a column:

CREATE TABLE CountryList ( Id INT IDENTITY PRIMARY KEY, CountryName VARCHAR(255) NOT NULL, CountryPopulation INT CHECK(CountryPopulation > 0) ) ALTER TABLE student ADD CONSTRAINT CheckSage CHECK (sage > 25);Adding a "Foreign Key"

CREATE TABLE Orders ( OrderID int NOT NULL, OrderNumber int NOT NULL, PersonID int, PRIMARY KEY (OrderID), FOREIGN KEY (PersonID) REFERENCES Persons(PersonID) );Creating a 'Composite Primary Key'

Create table StudentCourse ( stid integer FOREIGN Key REFERENCES Student (sid) , cno integer Foreign Key References Course (cid), PRIMARY KEY (stid, cno) );A mistake that students make...

Create table StudentCourse ( stid integer Primary Key FOREIGN Key REFERENCES Student (sid), cno integer PRIMARY key Foreign Key References Course (cid) ); Msg 8110, Level 16, State 0, Line 1 Cannot add multiple PRIMARY KEY constraints to table 'StudentCourse'.Oracle DB

SQL> create table student_ashish_12345 (sid int primary key, sname varchar2(10), sbranch char(5), sage int constraint stud_sage_ck check (sage <= 25)); SQL> create table course_ashish_12345 (cid int primary key, cname char(4) unique, units int); SQL> create table studentcourse_ashish_12345 (stid int, cno int, constraint sc_pk primary key(stid, cno), constraint sc_fk1 foreign key (stid) references bits_student (sid), constraint sc_fk2 foreign key (cno) references bits_course (cid)); SQL> select table_name from tabs where table_name like '%ASHISH_12345';

Stock Tips 2022-Feb-05

Apollo Hospitals - One Day

Apollo Hospitals - Past 5 years

Apollo Hospitals - All Time

Asian Paints - 1 Day

HDFC AMC - All Time

Nifty50 - All Time

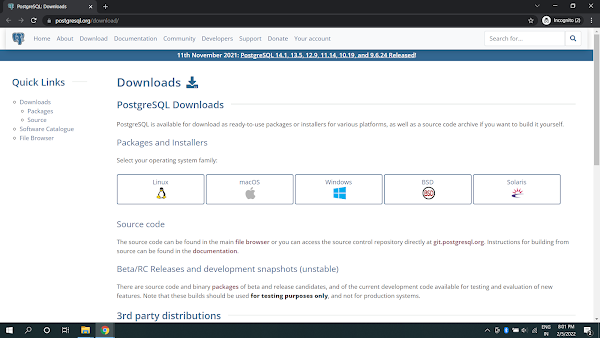

Tags: Investment,Installing PostGRE Database on Windows 10

Subscribe to:

Comments (Atom)