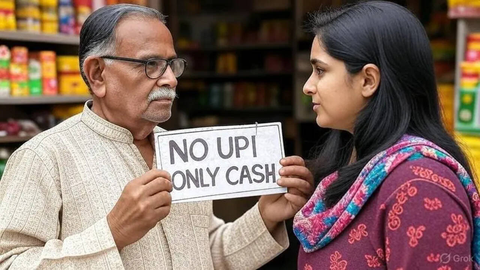

"Cash Only, Please!" – Why Bengaluru Vendors Are Shunning UPI (And What the Taxman Says)

Ever tried to pay with UPI at your favourite Bengaluru street vendor, only to be met with a firm "Cash Only" sign? You're not alone. This isn't a tech glitch; it's a growing trend born out of a surprising fear: the Goods and Services Tax (GST).

Many small shopkeepers and vendors in Bengaluru have started putting up these signs because they're worried about the taxman. Their logic? They believe that if they accept digital payments like UPI, the tax department will easily track their income and send them GST notices. It's a classic case of "if they can't see it, they can't tax it."

The Tax Department's Take: Don't Panic!

But here's the crucial clarification from the Commercial Tax Department: their fears are largely misplaced. Officials have clearly stated that GST notices aren't issued solely based on UPI transactions. They look at all your sales – whether you get paid through UPI, card machines, bank transfers, or even good old cash.

Think of GST as a tax on the 'value' you add when you sell goods or services. It applies to all the money you receive for your sales, no matter how you get it. So, simply avoiding UPI won't make you 'invisible' to the taxman if you're earning above the threshold. In fact, the department stressed that they will take action to collect applicable taxes from traders who have received money in any form.

Why the Confusion Now?

This whole situation flared up after the tax department reminded businesses about GST registration rules. If you sell goods worth more than Rs 40 lakh a year, or provide services worth more than Rs 20 lakh a year, you're required to register for GST.

It's also important to understand the bigger picture. The Karnataka government has a significant target to collect taxes – a whopping Rs 1.20 lakh crore for 2025-26. This money is vital for funding various welfare schemes and much-needed infrastructure projects across the state, especially with Chief Minister Siddaramaiah juggling welfare guarantees and demands for development.

The Bottom Line

The message from the authorities is clear: keep using UPI! It's a convenient payment method for everyone. The key isn't how you get paid, but how much you earn. If your business crosses the GST threshold, you're liable for GST, regardless of whether you prefer cash or digital.

So, next time you see a 'Cash Only' sign, remember it's likely born out of a misunderstanding. The best approach for vendors is to understand the GST rules and comply, rather than shying away from digital convenience.

No comments:

Post a Comment