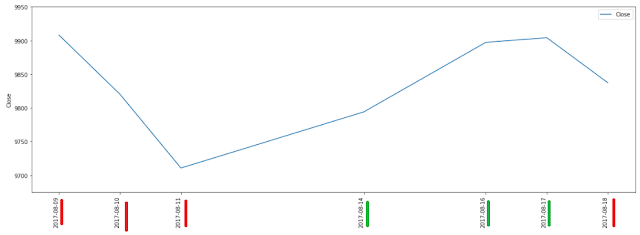

Day: 10th Aug 2017 Sensex tanks 267 points. Nifty hits one-month low. 1. Market outlook: Signals bearish; key Nifty support at 9880, 9820. [1] 2. Nifty likely to drift lower, crucial support at 9862: 4 stocks to trade today: Gaba [2] Here are 5 factors that spooked investors: ==> 1. Weak global markets: Markets from Japan to the UK were in the red on Thursday amid geopolitical concerns over North Korea’s nuke threat. Investors flocked to gold that hit a two-month high and other safe havens, such as Japanese yen and the Swiss franc. Hang Seng was the worst hit in Asian markets, having ended the session 1.34 per cent lower. In Europe, UK’s FTSE100 was worst hit with a 1.10 per cent fall. Euro Stoxx 50 fell 0.6 per cent to 3,448. ==> 2. Poor advance-decline ratio: The advance-decline ratio was 1:9 on Thursday, even though the broader market indices recovered about 1 per cent from day’s low. A weak advance-decline ratio signals that the euphoria is over. For some time, it was being observed that even as the benchmark Sensex and Nifty were scaling new heights, the broader market that includes midcap and smallcap stocks were not participating in the rally amid concerns over valuations. Of the 2,683 companies that traded on Thursday, only 390 ended higher, suggesting a broader selloff. As selling extended to the fourth session in a row, the euphoria got over and the bulls were on the back foot. ==> 3. Valuation concern: Time and again, analysts have warned of rich valuations in the market. Selling can come into a richly valued market for any reason, as investors tend to find excuse to book profits, when they do not expect their stock to sustain at prevailing valuations. The Sensex is trading at price-to-earnings ratio of 24 compared with a five-year average PE of 19.23 and 10-year PE average of 19.33. "A 500-point froth that we were seeing on the Nifty50 is geting corrected." Sanjiv Bhasin, EVP-Markets & Corp Affairs at India Infoline ==> 4. Sebi order: Sentiment has been weak in the cash market ever since Sebi barred 331 stocks from trading, suspecting most of the firms being 'shell'. There has been repors suggesting that the ban has triggered an estimated margin shortfall of around Rs 800-1,000 crore. “When the fall has to happen, you have to find a reason for it. The ongoing fall need not be attributable to Sebi ruling, but that is as good a reason, as any,” said Anand Tandon, Independent Analyst. ==> 5. Slowdown in FPI inflows: Inflows from foreign portfolio investors into India have slowed of late as rich valuations and delay in corporate earnings recovery have reduced their appetite for domestic stocks. After pouring over Rs 50,000 crore in equity markets during February-July, foreign portfolio investors have sold shares worth Rs 2,549 crore (net) in August so far, according to data available with depository NSDL. Day: 11th Aug 2017 Nifty, Sensex lose over 1% to close one month lower, SBI tanks 5% on poor Q1 results BSE Sensex closed lower by 318 points, or 1.01%, to 31,214, while the Nifty 50 fell 109 points, or 1.11%, to 9,711. The BSE Sensex lost over 1% to close at 31,214 points on Friday for its first weekly loss in six, tracking global markets as escalating tensions between the US and North Korea continued to drive investors away from risk assets. Asian equity markets slid further and Wall Street closed sharply lower after US President Donald Trump warned Pyongyang against attacking Guam or US allies. “The mood got aggravated because global markets opened negatively... it’s more of a fear factor...,” said Anita Gandhi, whole-time director, Arihant Capital Markets, adding that markets were overripe in terms of valuation. The broader NSE Nifty also closed down, falling 1.11% to close at 9,710.80. The benchmark BSE Sensex was 0.69% lower at 31,313.59. Both indexes are set to post nearly three percent fall on week. Nifty Bank index dropped as much as 1.3%. The index was down nearly 2.5% this week up to Thursday’s close. Nifty Auto index fell as much 2.3% to its lowest since 24 May, with Tata Motors and Eicher Motors figuring among top losers. Union Bank of India Ltd fell as much as 7.7% to its lowest in over seven months after the state-run bank’s profit fell about 30 percent, missing analysts’ estimate. Shares of J Kumar Infraprojects and Prakash Industries resumed trade after India’s Securities Appellate Tribunal stayed a Securities and Exchange Board of India (Sebi) order on trading curbs. Shares in both companies shed as much as 20%." "livemint.com" With inputs from Reuters: ■ 3.30pm: BSE Sensex closed lower by 318 points, or 1.01%, to 31,214, while the Nifty 50 fell 109 points, or 1.11%, to 9,711. SBI, M&M and ONGC are major losers with losses to the tune of 5.38%, 3.20%, and 2.26%, respectively. ■ 3.15pm: BSE Sensex trades lower by 291 points, or 0.92%, to 31,241, while the Nifty 50 falls 115 points, or 1.17%, to 9,705. Metal, auto and realty stocks fall. BSE metal index falls 3.64%, BSE auto index declines 1.52%, and BSE realty index falls by 1.23%. ■ 2.20pm: BSE Sensex trades lower by 400 points, or 1.27%, to 31,132, while the Nifty 50 falls 132 points, or 1.35%, to 9,688. Auto index falls 2.2%. ■ 1.45pm: SBI (State Bank of India) stock falls 4.75% on poor Q1 earnings. ■ 1.17pm: BSE Sensex trades lower by 258 points, or 0.82%, to 31,274, while the Nifty 50 falls 85 points, or 0.87%, to 9,735. Tata Motors, Laresen & Toubro (L&T) and SBI are major losers with losses to the tune of 2%, 2.08%, and 3.56%, respectively. ■ 12.15pm: Among 30 Sensex stocks, 23 (out of 30) trade in red, while only seven are in green. In Nifty, 35 stocks post losses while only 15 are in positive range. ■ 11.55am: BSE Sensex trades lower by 185 points, or 0.59%, to 31,346, while the Nifty 50 falls 62 points, or 0.63%, to 9,758. Asian Paints, Larsen & Toubro (L&T) fall 2%, and 1.66%, respectively. ■ 10.30am: Manappuram Finance Ltd fell 9% to Rs85.15 after the company reported 3.22% decline in its net profit to Rs155.17 crore against Rs160.33 crore a year ago. ■ 10.20am: Adani Group stocks fell. Adani Transmission Ltd fell 7.5%, Adani Power Ltd 5%, Adani Entertainment Ltd 3.7%. ■ 10.15am: Indian Overseas Bank (IOB) fell 4% to Rs22.30 after the bank reported a net loss of Rs646.66 crore against Rs1,450.50 crore a year ago. ■ 10.10am: Union Bank of India fell 6% to Rs126.35 after the bank reported worsened asset quality to 12.63% in June quarter from 10.16% a year ago. ■ 9.50am: Balaji Telefilms Ltd fell 2% to Rs 151 after the company said its loss of the quarter widened to Rs 23.25 crore against Rs 67 lakh a year ago. ■ 9.40am: Power Finance Corporation (PFC) Ltd fell 4.7% to Rs118.45 after the company reported 16.6% shrinkage in profits from a year ago to Rs14.29 crore against Rs 17.13 crore a year ago. ■ 9.37am: BSE Sensex trades lower by 252 points, or 0.80%, to 31,280, while the Nifty 50 falls 89 points, or 0.91%, to 9,731. ■ 9.36am: Prakash Industries Ltd fell 20%, J Kumar Infraprojects Ltd 20% after the Securities Appellate Tribunal (SAT) on Thursday stayed a 7 August Securities and Exchange Board of India (Sebi) directive against J. Kumar Infraprojects Ltd and Prakash Industries Ltd labelling them suspected shell companies. ■ 9.30am: Tata Motors Ltd fell 5% to Rs362.65. The company on Wednesday reported lower then expected performance by its JLR led by higher than expected forex losses and significant increase in other expenses. ■ 9.25am: IFCI Ltd fell 10% to Rs21 after the company said its net loss widened to Rs317.90 crore in June quarter to Rs110.28 crore a year ago. ■ 9.15am: The rupee was trading at 64.26 a dollar, down 0.29% from its Tuesday’s close of 64.08. The rupee opened at 64.21 a dollar and touched a high of 64.27, a level last seen on 26 July. ■ 9.10am: The 10-year bond yield was at 6.501%, a level last seen on 7 July, compared to its previous close of 6.466%. Bond yields and prices move in opposite directions. ■ 9.00am: Asian currencies were trading lower. Philippines peso was down 0.51%, South Korean won 0.38%, China renminbi 0.35%, Indonesian rupiah 0.23%, Taiwan dollar 0.17%, Malaysian ringgit 0.1% and Thai baht 0.05%. However, Japanese yen was up 0.26%." Day: 14th Aug 2017 Stock market were bullish today. ==> Avanti Feeds hits record high after stellar Q1 numbers (Capital Market - Aug 14 2017, 09:45). The result was announced after market hours on Friday, 11 August 2017. Meanwhile, the S&P BSE Sensex was up 227.05 points, or 0.73% at 31,440.64. The S&P BSE Mid-Cap index was up 234.86 points, or 1.59% at 14,961.13. High volumes were witnessed on the counter. On the BSE, 43,000 shares were traded on the counter so far as against the average daily volumes of 27,648 shares in the past one quarter. ==> Sun Pharma drops after bitter Q1 outcome (Capital Market - Aug 14 2017, 09:20). The announcement was made after market hours on Friday, 11 August 2017. Meanwhile, the S&P BSE Sensex was up 128.04 points or 0.46% at 31,356.01. On the BSE, 76,000 shares were traded on the counter so far as against the average daily volumes of 5.54 lakh shares in the past one quarter. ==> Adani Ports recovers after posting Q1 results (Capital Market - Aug 14 2017, 09:49). The announcement of results was made on Saturday, 12 August 2017. The stock had dropped 7.27% in three sessions to settle at Rs 383.90 on 11 August 2017, from a close of Rs 414 on 8 August 2017 ahead of the results. Meanwhile, the S&P BSE Sensex was up 214.63 points or 0.69% at 31,428.22. On the BSE, 21,989 shares were traded on the counter so far as against the average daily volumes of 3 lakh shares in the past one quarter. Nifty under pressure, support seen at 9700. [1] Nifty has entered the oversold territory but this may just be a pause in a bull market. The Nifty may find support around the 9,650-9,700 levels. Investors will be better suited to avoid stocks in the realty & infra sectors. In the coming weeks, on the downside 9,440 will be an important level to watch." Day: 16th Aug 2017 Closing Bell: Sensex ends 321 pts higher, Nifty ends a tad below 9900; FMCG, banks gain The Sensex ended up 321.86 points at 31770.89, while the Nifty ended higher by 103.15 points at 9897.30. 3:30 pm Market at Close: Equity benchmark indices ended the session on a very strong note, with the Sensex ending 320 points higher and the Nifty ended just a tad below 9900. The Sensex ended up 321.86 points at 31770.89, while the Nifty ended higher by 103.15 points at 9897.30. The market breadth was positive, but a tad narrow as 1,638 shares advanced against a decline of 946 shares, while 118 shares were unchanged. Cipla, Tata Motors and Tech Mahindra gained the most on both indices, while NTPC, Asian Paints and Power Grid were the top losers. 3:18 Market Check: Benchmark indices had a strong trading session, with the Nifty nearing 9900-mark. The Sensex was up 324.48 points at 31773.51, while the Nifty was up 103.95 points at 9898.10. The market breadth was narrow as 1593 shares advanced against a decline of 896 shares, while 113 shares were unchanged. 3:15 pm UDAY scheme update: Debt-laden power distribution companies in states which participated in the UDAY scheme, meant for their revival, have saved Rs 15,000 crore till March this year, the power ministry said today. The Ujwal DISCOM Assurance Yojana (UDAY) was launched in November, 2015 and has completed more than 18 months of operation. "The participating DISCOMs have achieved net savings of approximately Rs 15,000 crore till March, 2017," the ministry said in a statement. The Average Cost of Supply (ACS) and Average Revenue Realised (ARR) gaps have come down by almost 14 paise per unit and the AT&C (aggregate technical and commercial) losses have reduced by almost 1 per cent in fiscal 2017, it said. 3:00 pm Management Speak: Satin Creditcare Network reported its numbers with net loss widening sequentially. In an interview to CNBC-TV18, HP Singh, Founder & MD of Satin Creditcare Network discussed the company's Q1 performance. Singh said there has been a lag in repayments coming in and this is the last quarter where we are facing headwinds from demonetisation, so there is a loss in Q1. ""75 percent of our territories were impacted by demonetisation. This is considering Uttar Pradesh (UP), Madhya Pradesh, Punjab, Haryana, Maharashtra, if we consolidate all that, we have probably been impacted in about 75 percent of our geographies,"" he added. 2:50 pm Fresh start: A new team of experts and top bureaucrats will likely finalise Finance Minister Arun Jaitley's fifth Union Budget that will sport a different look, starting with a lighter `Part B’ with fewer indirect tax changes because of GST and an expected change in the financial year. The current financial year witnessed key entries and exits into the North Block, starting from a new Economic Affairs Secretary Subhash Chandra Garg, who will spearhead the budget making process for 2018-19. Chandra replaced Shaktikanta Das, who retired in May. Similarly, two key finance ministry officials, Department of Financial Services Secretary Anjuly Chib Duggal and Finance Secretary Ashok Lavasa will retire in August and October, respectively, unless they get an extension. 2:40 pm Buzzing Stock: Shares of Coal India slipped nearly 2 percent on the back of poor first quarter numbers. The company's Q1FY18 net profit declined 23.3 percent at Rs 2,351.2 crore against Rs 3,065.3 crore in a year ago period. Revenue of the company was up 4.3 percent at Rs 20,567.8 crore versus RS 19,728.05 crore. The operating profit (EBITDA) declined 17.8 percent at Rs 3,552.7 crore and EBITDA margin was down at 480 bps 18.4 percent. 2:15 pm Market Check: Benchmark indices strengthened their position from the morning movements, with the Nifty firmly above 9850-mark. The Sensex was up 248.36 points at 31697.39, while the Nifty was up 72.55 points at 9866.70. The market breadth was narrow as 1,527 shares advanced against a decline 899 shares, while 102 shares were unchanged. Midcaps continued to gain, while a major recovery was seen among banks. ITC, Tata Motors, Tech Mahindra, and Tata Power gained the most on both indices, while Asian Paints, Coal India, and Asian Paints were the top gainers. 2:00 pm Europe Check: European stocks were higher on Wednesday morning, as geopolitical tensions regarding the Korean peninsula eased and investors tracked a muted performance overnight on Wall Street. The pan-European Stoxx 600 rose 0.53 percent shortly after the opening bell with almost all sectors and major bourses in positive territory. 1:55 pm Buzzing Stock: Granules India gained nearly 10 percent intraday on Wednesday as investors cheered positive news flow for the company. The company on Wednesday said that no observations were made by the US Food and Drug Administration (FDA) for its Gagillapur unit. The company received the Establishment Inspection Report (EIR) for an inspection that was carried in October 2016. The company recently was in the news after it reported a 5.5 percent fall in its June quarter profit. The drug firm reported a 5.54 percent decline in its consolidated net profit at Rs 36.80 crore for the quarter to June. 1:30 pm Management Speak: Prabhat Dairy reported its Q1FY18 numbers. In an interview to CNBC-TV18, Vivek Nirmal, Joint MD of Prabhat Dairy spoke about the results and his outlook for the company. Prabhat Dairy is a leading company in a B2B space and 2011 onwards, the company is focusing on the consumer business. Except South India, we are present in around 25-26 states with more than 1 lakh retail outlets in general trade, he said. In modern trade, earlier Prabhat was only present in Maharashtra but now it is also expanded in Delhi and Kolkata and Ahmedabad. All these factors contributed to the growth of the value added products, he added. 1:10 pm: Pushed higher by a recovery in midcaps and banking stocks, the market in the afternoon session extended its gains and Nifty was above 9800-mark. At 13:02 hrs, the Sensex was up 168.13 points at 31617.16, while the Nifty was up 47.70 points at 9841.85. The market breadth was still narrow as 1,459 shares advanced against a decline of 893 shares, while 97 shares were unchanged. The Nifty Bank, after falling to levels of 23947, staged a bounceback and led to the strong recovery in Kotak Mahindra Bank. Midcaps staged a recovery from the day’s low points, outperforming the Nifty during the current session. Autos, bank, FMCG, pharmaceuticals, IT and metals gained the most. 12:53 pm Management Speak: Aarti Industries is in focus on the back of a subdued first quarter. In an interview to CNBC-TV18, Rajendra Gogri, CMD of the company discussed the Q1 performance. Full-fledged shutdown of acid division had an impact of Rs 8-10 crore, said Gogri. However, we are looking at volume growth of 10 percent in FY18, he added. 12:28 pm Bullion update: Gold prices drifted lower by Rs 153 to Rs 28,958 per 10 grams in futures trade today as participants lightened their positions, largely in tandem with a weak overseas trend. In futures trading, gold for delivery in far-month December was trading Rs 153 or 0.52 per cent down at Rs 28,997 per 10 grams at the Multi Commodity Exchange with a business turnover of six lots. 12:15 pm Market Check: Benchmark indices extended its gains from the previous hour, with the Nifty trading above 9800-mark. At 12:14 hrs IST, the Sensex traded up 71.85 points at 31520.88, while the Nifty was up 18.60 points at 9812.75. The market breadth was narrowing as 1,388 shares advanced against a decline of 875 shares, while 92 shares were unchanged. ITC, Hero MotoCorp, Tech Mahindra and Tata Power gained the most on both indices, while Asian Paints, Larsen & Toubro, Yes Bank and Bosch were the top losers. 11:41 am GST impact: The estimated Rs 5,500 crore capital good leasing sector growing at 15-20 per cent may get tapered due to high Goods and Services Tax (GST) along with few other issues. ""The GST rate of 28 per cent is high for the leasing industry when compared to the earlier five to 15 per cent tax burden. Higher GST rates lead to requirement of higher working capital at any point of time. This results in increasing the cost of leasing an equipment,"" Finance Industry Development Council director general Mahesh Thakkar told PTI. ""The government should actively consider not bracketing the capital goods in the same GST bracket as luxury goods and sin goods. A lower GST rate will help increasing share of leasing in gross capital formation,"" he said. (From PTI) 11:29 am Management Speak: The movie business has been weathering storms in recent months in the form of demonetisation and the Goods and Services Tax (GST), but leading cinema-exhibition company PVR has its eyes firmly set on attracting more audiences. The company recently launched 10 more screens in Pune as part of its expansion plans, taking its screen count in Maharashtra to 160 screens across 38 properties. After Pune, cities such as Mysore, Hyderabad, Chennai and Ghaziabad will see the launch of around two to three screens each in the next few months. In all, the company currently has nearly 600 screens in India and adds about 70-75 screens every year, Chief Executive Officer Gautam Dutta told Moneycontrol. The capital expenditure for each new screen is around Rs 2.5 crore on average. Cinema's classification in the highest GST tax slab of 28 percent, however, is being considered by industry experts to be a stumbling block. Ajay Bijli, PVR's Chairman and Managing Director, has previously said that had it not been for the high GST rate, the company would have been scaling up opportunities for the domestic box office. Dutta said that while no negative effects of GST have been felt so far, he expects the government to take the entertainment business seriously. 11:07 am Market Check: Benchmark indices were trading off the day’s low points, with the Nifty hovering 9800-mark. At 11:01 hrs, the Sensex was up 45.85 points at 31494.88, while the Nifty traded higher by 10.85 points at 9805.00. The market breadth continued to be narrow as 1,341 shares advanced against a decline of 753 shares, while 88 shares were unchanged. Midcaps are back in the green, while pharma, metals, IT and FMCG too gained. Banks were a laggard. 10:55 am Buzzing Stock: Jubilant Foodworks, the operator of Domino’s Pizza and Dunkin’ Donuts, gained around 6 percent intraday on Wednesday as investors cheered a target price hike by CLSA. The global research firm increased the target price on the stock from Rs 1,600 to Rs 1,900, implying an upside of over 18 percent. Further, CLSA also raised the target PE multiple from 55 times to 60 times as well. Affirming its positive stance is also the increase in same store sales growth (SSSG) and FY19-20 earnings per share (EPS) forecasts by 6-12 percent as well. 10:45 am Management Speak: Apollo Hospitals Enterprises' Q1 revenues came in line with street estimates while overall occupancy improved. In an interview to CNBC-TV18, Suneeta Reddy, MD of Apollo Hospitals Enterprises discussed the company's Q1 performance. June quarter EBITDA margins are low because of losses incurred at Navi Mumbai unit, she said. She further said that EBITDA margin also impacted due to regulation in stent pricing. 10:25 am Mutual Fund Radar: The total assets of the 10 largest India-focussed offshore funds and ETFs swelled during the quarter ended June 2017 compared with the previous quarter. It ended the June quarter at USD 27.3 billion compared with USD 25.4 billion in the previous quarter and USD 20.5 billion as of June 30, 2016, Morningstar said in a report. Positive environment in the domestic markets kept sentiments in the Indian stock markets upbeat, leading almost all the major domestic stock market indexes to surge during the quarter, said the report. The S&P BSE Sensex Index moved up by 4.4 percent, although it was lower than the 11.2% appreciation it witnessed in the previous quarter (ended March 2017). 10:10 am Market Check: Consolidation continued on equity benchmarks, with Sensex trading flat, while the Nifty had a negative bias. The drag was led by a fall in banks—Nifty Bank and PSU bank index were trading in the red—while pharmaceuticals and FMCG stocks were in the green. At 10:03 hrs, the Sensex was up 4.74 points at 31453.77, while the Nifty was down 2.25 points at 9791.90. The market breadth was narrow as 1111 shares advanced against a decline of 714 shares, while 68 shares were unchanged. Sun Pharma, HUL, ITC and Tata Power gained the most, while L&T, Coal India and Bank of Baroda were the top losers. 9:55 am Biocon declines: Shares of Biocon took a beating on Wednesday morning as investors turned cautious of the stock following a report from a research firm. It fell over 5 percent intraday. HSBC in its report hinted that the company may have withdrawn one application for Trastuzumab, a breast cancer similar. The firm quoted the European Medical Agency (EMA) as its source for the information. Further, it added, that the company could have withdrawn its filing given the recent cGMP (good manufacturing practices) observations that were issued by the regulator. 9:45 am Buzzing Stock: Shares of JK Tyre and Industries declined nearly 8 percent intraday on Wednesday as the company reported net loss in the quarter ended June 2017 (Q1FY18). The company registered consolidated loss at Rs 108 crore in the quarter ended June 2017 against profit of Rs 100 crore, in the same quarter last year. Revenue of the company was down at Rs 1,943 crore versus Rs 1,958 crore. 9:35 am Update: Benchmark indices were off the day’s high points, with the Nifty falling below 9800-mark. The Sensex was down 23.80 points at 31425.23, while the Nifty fell 7.35 points at 9786.80. The market breadth was narrowing as 1,028 shares advanced against a decline of 521 shares, while 57 shares were unchanged. L&T, Coal India and Bank of Baroda lost the most on both indices, while HUL, HDFC, Indiabulls Housing and Tata Power gained the most. 9:15 am Market Opens: Equity benchmarks continued with its positive momentum from the previous session and opened on a good note, with the Nifty reclaiming 9800-mark. At 9:16 am, the Sensex was up 77.14 points at 31526.17, while the Nifty rose 23.05 points at 9817.20. The market breadth was positive as 626 shares advanced against a decline of 186 shares, while 27 shares were unchanged. Midcaps were back in favour as they outperformed the benchmarks, while other gainers included FMCG, auto stocks and metals. Adani Ports, Tata Motors, Tata Power and BPCL were the top gainers, while Larsen & Toubro, Cipla and Asian Paints lost the most on both indices. The Indian rupee slipped in the early trade on Wednesday. It has opened lower by 16 paise at 64.28 per dollar versus 64.12 Monday. Pramit Brahmbhatt of Veracity said, ""Encouraging US economic data and FII outflows will help the dollar appreciate. We expect the USD-INR to trade in a range of 64-64.50 for the day."" The US dollar strengthened after economic data, including July retail sales, beat expectations and cast the economy in a relatively favourable light. Among global markets, Asian shares were mostly higher in early trade as investors digested earnings releases from regional corporates and a resurgent dollar. Japan's Nikkei 225 edged down 0.03 percent, with gains in most tech stocks offset by losses in auto names. South Korea's Kospi rose 0.67 percent as markets returned from a public holiday. Australia's S&P/ASX 200 gained 0.07 percent, as steep gains in the energy sub-index, which was up by 3.26 percent, were offset by declines in the health care, information technology and financial sub-indexes. US stocks ended little changed on Tuesday as declines in Home Depot and other retailers following results offset upbeat US retail sales data. The S&P 500 consumer discretionary index, down 0.9 percent, also took a hit from a steep fall in the shares of Coach and Advance Auto Parts after disappointing results. The S&P 500 retail index was down 1.6 percent." Ref: moneycontrol.com Day: 18th Aug 2017 Sensex loses 230 points, Nifty below 9,900 after Vishal Sikka resigns as Infosys CEO. BSE Sensex fell significantly on Friday, while the Nifty fell below 9,900. Infosys shares plunge 6% after Vishal Sikka resigned as CEO and managing director. Mumbai: The BSE benchmark Sensex fell nearly 230 points and Infosys tanked over 7% after Vishal Sikka resigned as MD and CEO of Infosys with immediate effect. Besides, weak global cues on a deadly attack in Spain and rising concerns over the fate of US President Donald Trump’s economic agenda also influenced investors sentiment. The markets also witnessed intense selling pressure in recent gainers. The Sensex plunged by 207.75 points or 0.65% to 31,587.711 with the sectoral indices led by IT, teck, bank, healthcare, metal, auto and realty, tumbling up to 2.43%. The gauge had gained 581.87 points in the previous three sessions. On similar lines, the National Stock Exchange (NSE) index Nifty dropped by 73.95 points or 0.74% to 9,830.20. Brokers said sentiment on the domestic bourses suffered a jolt following a meltdown global equities on a deadly attack in Spain and renewed concerns over the fate of US President Donald Trump’s economic agenda. Other laggards that dragged down the key indices were Sun Pharma, HDFC Ltd, Tata Motors, SBI, Kotak Bank, HDFC Bank, Lupin, Adani Ports, Axis Bank, Dr Reddy’s, Coal India and Tata Steel. In Asia, Japan’s Nikkei fell 1.02%, while Shanghai Composite Index was quoting 0.33% lower in early trade today. Hong Kong’s Hang Seng index too shed 0.82%. The Dow Jones Industrial Average ended 1.24% lower in Thursday’s trade. ■ 10.56am: BSE Sensex trades lower by 230 points, or 0.72%, to 31,566, while the Nifty 50 falls 56 points, or 0.56%, to 9,848. BSE healthcare index declines by 1.49%. ■ 10.10am: BSE Sensex trades lower by 210 points, or 0.66%, to 31,586, while the Nifty 50 falls 53 points, or 0.53%, to 9,851. Infosys shares bring IT index down. BSE IT index falls 2.16% as Infosys shares fall 6%. Nifty IT index also trades lower by 1.09%. ■ 9.30am: BSE Sensex trades lower by 253 points, or 0.80%, to 31,542, while the Nifty 50 fell 84 points, or 0.85%, to 9,820. ■ 9.25am: Infosys Ltd fell 6% after the company said Vishal Sikka has resigned as chief executive officer and will become the company’s executive vice chairman. Pravin Rao, currently chief operating officer, will become interim managing director and CEO. ■ 9.20am: United Breweries Holdings Ltd fell 5% to Rs 17.60 after BSE and NSE said that they will suspend trading in the shares of United Breweries (Holdings) Ltd from 8 September while the entire promoter shareholding has been frozen with immediate effect. Trading in UBHL would be suspended from 8 September “on account of non-compliance with financial results and non- payment of fine for two consecutive quarters”, NSE said in a communication. ■ 9.15am:The rupee opened at 64.17 a dollar. At 9.15am, the rupee was trading at 64.16 a dollar, down 0.02% from its Wednesday’s close of 64.14. On Thursday, currency markets were closed on account of Parsi New Year. ■ 9.10am: The 10-year bond yield was at 6.497%, compared to its previous close of 6.507%. Bond yields and prices move in opposite directions. ■ 9.05am: Asian currencies were trading lower. Philippines peso was down 0.54%, South Korean won 0.38%, Taiwan dollar 0.1%, Indonesian rupiah 0.05%, Malaysian ringgit 0.05%. However, Singapore dollar was up 0.12%, and Japanese yen 0.11%." Ref: 3 References: 1: economictimes.indiatimes.com 2: moneycontrol.com 3: Sensex, Nifty tank, Infosys shares plunge as Vishal Sikka resigns

Thursday, April 2, 2020

Effects of news and world events on Nifty50 and stock market

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment