Name : Industry : Weight : Ticker Symbol : Max Change 1. Reliance Industries Ltd. Energy - Oil & Gas 10.56% NSE: RELIANCE Max: 4,397.26% 2. HDFC Bank Ltd. Banking 8.87% NSE: HDFCBANK Max: 27,044.93% 3. Infosys Ltd. Information Technology 8.62% NSE: INFY Max: 14,904.31% 4. ICICI Bank Ltd. Banking 6.72% NSE: ICICIBANK Max: 19,581.37% 5. Housing Development Finance Corporation Ltd. Financial Services 6.55% NSE: HDFC Max: 11,002.82% 6. Tata Consultancy Services Ltd. Information Technology 4.96% NSE: TCS Max: 3,026.11% 7. Kotak Mahindra Bank Ltd. Banking 3.91% NSE: KOTAKBANK Max: 76,383.33% 8. Larsen & Toubro Ltd. Construction 2.89% NSE: LT Max: 10,273.22% 9. Hindustan Unilever Ltd. Consumer Goods 2.81% NSE: HINDUNILVR Max: 1,273.49% 10. ITC Ltd. Consumer Goods 2.63% NSE: ITC Max: 1,258.62% 11. Bajaj Finance Ltd. Financial Services 2.52% NSE: BAJFINANCE Max: 2,472.71% 12. State Bank of India Banking 2.40% NSE: SBIN Max: 3,454.01% 13. Bharti Airtel Ltd. Telecommunication 2.33% NSE: BHARTIARTL Max: 3,589.90% 14. AXIS Bank Ltd. Banking 2.29% NSE: AXISBANK Max: 23,676.63% 15. Asian Paints Ltd. Consumer Goods 1.92% NSE: ASIANPAINT Max: 27,092.34% 16. HCL Technologies Ltd. Information Technology 1.68% NSE: HCLTECH Max: 863.31% 17. Bajaj Finserv Ltd. Financial Services 1.41% NSE: BAJAJFINSV Max: 2,472.71% 18. Titan Company Ltd. Consumer Goods 1.35% NSE: TITAN Max: 58,143.56% 19. Tech Mahindra Ltd. Information Technology 1.30% NSE: TECHM Max: 975.59% 20. Maruti Suzuki India Ltd. Automobile 1.28% NSE: MARUTI Max: 5,069.17% 21. Wipro Ltd. Information Technology 1.28% NSE: WIPRO Max: 4,026.81% 22. UltraTech Cement Ltd. Cement 1.17% NSE: ULTRACEMCO Max: 2,762.54% 23. Tata Steel Ltd. Metals 1.14% NSE: TATASTEEL Max: 1,652.77% 24. Tata Motors Ltd. Automobile 1.12% NSE: TATAMOTORS Max: 1,479.58% 25. Sun Pharmaceutical Industries Ltd. Pharmaceuticals 1.10% NSE: SUNPHARMA Max: 38,939.65% 26. Mahindra & Mahindra Ltd. Automobile 1.09% NSE: M&M Max: 3,953.25% 27. Power Grid Corporation of India Ltd. Energy - Power 0.96% NSE: POWERGRID Max: 178.26% 28. Nestle India Ltd. Consumer Goods 0.93% NSE: NESTLEIND Max: 628.12% 29. Grasim Industries Ltd. Cement 0.86% NSE: GRASIM Max: 3,554.15% 30. HDFC Life Insurance Co. Ltd. Insurance 0.86% NSE: HDFCLIFE Max: 74.09% 31. Divi’s Laboratories Ltd. Pharmaceuticals 0.84% NSE: DIVISLAB Max: 48,055.56% 32. Hindalco Industries Ltd. Metals 0.82% NSE: HINDALCO Max: 1,120.50% 33. JSW Steel Ltd. Metals 0.82% NSE: JSWSTEEL Max: 1,598.23% 34. NTPC Ltd. Energy - Power 0.82% NSE: NTPC Max: 114.66% 35. Dr. Reddy’s Laboratories Ltd. Pharmaceuticals 0.77% NSE: DRREDDY Max: 6,989.02% 36. IndusInd Bank Ltd. Banking 0.72% NSE: INDUSINDBK Max: 4,266.52% 37. Oil & Natural Gas Corporation Ltd. Energy - Oil & Gas 0.70% NSE: ONGC Max: 630.89% 38. SBI Life Insurance Co. Insurance 0.69% NSE: SBILIFE Max: 62.03% 39. Adani Port and Special Economic Zone Infrastructure 0.68% NSE: ADANIPORTS Max: 294.38% 40. Cipla Ltd. Pharmaceuticals 0.67% NSE: CIPLA Max: 4,020.15% 41. Tata Consumer products Ltd. Consumer Goods 0.63% NSE: TATACONSUM Max: 3,291.92% 42. Bajaj Auto Ltd. Automobile 0.57% NSE: BAJAJ-AUTO Max: 1,226.10% 43. Britannia Industries Ltd. Consumer Goods 0.57% NSE: BRITANNIA Max: 5,936.41% 44. UPL Ltd. Chemicals 0.51% NSE: UPL Max: 64,233.33% 45. Bharat Petroleum Corp. Ltd. Energy - Oil & Gas 0.48% NSE: BPCL Max: 1,806.20% 46. Shree Cement Ltd. Cement 0.47% NSE: SHREECEM Max: 84,322.44% 47. Eicher Motors Ltd. Automobile 0.45% NSE: EICHERMOT Max: 215,785.25% 48. Coal India Ltd. Mining 0.43% NSE: COALINDIA Max: -51.49% 49. Hero MotoCorp Ltd. Automobile 0.43% NSE: HEROMOTOCO Max: 2,411.03% 50. Indian Oil Corporation Ltd. Energy - Oil & Gas 0.41% NSE: IOC Max: 581.56%What is the eligibility criteria for selection of Nifty 50 stocks?

Eligibility Criteria for Selection of Constituent Stocks: i. Market impact cost is the best measure of the liquidity of a stock. It accurately reflects the costs faced when actually trading an index. For a stock to qualify for possible inclusion into the NIFTY50, have traded at an average impact cost of 0.50% or less during the last six months for 90% of the observations, for the basket size of Rs. 100 Million. ii. The company should have a listing history of 6 months. iii. Companies that are allowed to trade in F&O segment are only eligible to be constituent of the index. iv. A company which comes out with an IPO will be eligible for inclusion in the index, if it fulfills the normal eligibility criteria for the index for a 3 month period instead of a 6 month period.

Pages

- Index of Lessons in Technology

- Index of Book Summaries

- Index of Book Lists And Downloads

- Index For Job Interviews Preparation

- Index of "Algorithms: Design and Analysis"

- Python Course (Index)

- Data Analytics Course (Index)

- Index of Machine Learning

- Postings Index

- Index of BITS WILP Exam Papers and Content

- Lessons in Investing

- Index of Math Lessons

- Index of Management Lessons

- Book Requests

- Index of English Lessons

- Index of Medicines

- Index of Quizzes (Educational)

Wednesday, February 9, 2022

Nifty50 - A Detailed Report (2022-Feb-09)

Tuesday, February 8, 2022

Stock Tips (2022-Feb-8)

Yes Bank

On Feb-9, it might go to 14.60 INR. It can test out even 15 INR as well. Volume is also good. Very prospective stock for tomorrow. It has breached 200 EMA (Exponential Moving Average). It has attempted to come above 15 INR a couple of times before. - - - - -Blue Star

It has broken 200 EMA. 25% appreciation between 31-Jan-2022 and 7-Feb-2022. It makes even more sense to buy this stock today in February as the summers are coming (not joking). It is a 'Cyclic Seasonal Stock'. - - - - -Century Plyboards

Good stock but showing resistance at 630 INR.

Blue Star - 1 Month

Blue Star - Max (Since 2001)

Century Plyboards - 6 Months

Century Plyboards - 5 Years

Yes Bank - 5 Days

Yes Bank - 6 Months

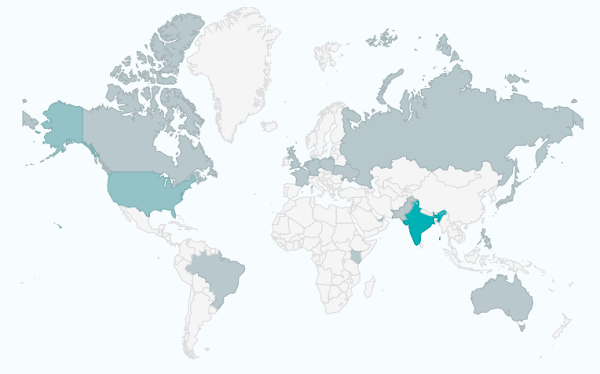

Tags: InvestmentAudience Around The World (Feb 2022)

Doughnut Chart Countries

World Heat Map

List of Top 20 Countries with View Counts

Top Locations

- India

- United States

- Germany

- Russia

- United Arab Emirates

- Kenya

- United Kingdom

- Singapore

- Canada

- Netherlands

- France

- Brazil

- Ukraine

- Philippines

- Hong Kong

- Australia

- Pakistan

- Japan

- Poland

Past 3 Months - Daily Views

Tags: Investment,Management,

Monday, February 7, 2022

Stock Tips 2022-Feb-7

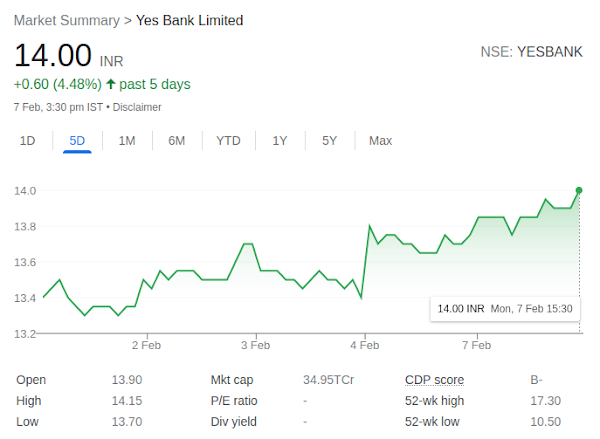

Yes Bank

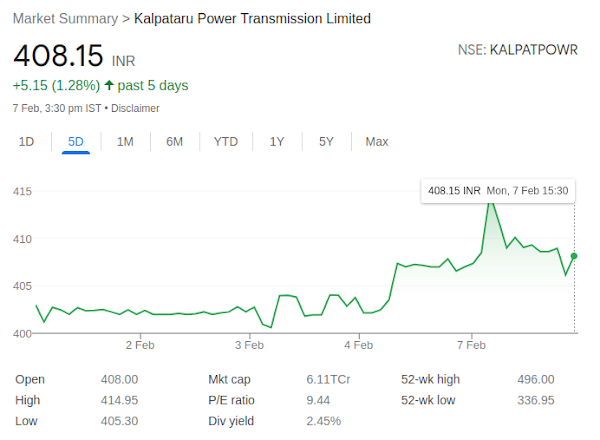

At 14.25, it has 200 EMA (Expotential Moving Average). 14.95 is it's resistance. If it breaks 15, then it might go to 18.Kalpataru Power

It has come above 200 EMA.Aarti Drugs Ltd.

It has come above 200 EMA in 'Hourly Candle'. For 'Daily Candle', it will try to come above 200 EMA.Dhani Services Ltd.

It is about to break previous resistance.Castrol India Limited

Div yield: 4.42% Very good dividend yield.In Images:

Aarti drugs ltd - 5 Years

Castrol - 1 Days

Dhani - 5 Days

Kalpataru power - 5 Days

Yes bank - 5 Days

Nifty50 - 5 Years

Tags: Investment,BODMAS - Step by Step Working (Grade 6A)

BODMAS: Brackets of Division, Multiplication, Addition, Subtraction

To solve the problem, we are following the way Google processes our above question, i.e., left to right.

Tags: Mathematical Foundations for Data Science,

Set the difficulty level:

To solve the problem, we are following the way Google processes our above question, i.e., left to right.

Also, to simplify calculations, we are rounding off answer from division part to the lower integer, i.e. floor function.

Subscribe to:

Comments (Atom)